Tesla’s India entry has stalled not because of lack of interest, but because India’s import duties, cost structures, and policy certainty do not yet align with Tesla’s global operating model.

That single reality explains years of confusing headlines.

Problem: Every few months, news breaks that Tesla is “coming to India.”

Agitation: Consumers expect launches, investors expect timelines, and nothing materializes.

Solution: The right question is not “Is Tesla coming to India?” but “Under what conditions does Tesla enter India—and have those conditions changed?”

Direct answer: Tesla will enter India only when importing or manufacturing cars makes economic sense at scale. As of now, those conditions are only partially met.

Key Takeaways

- Tesla has engaged with India multiple times without final commitment

- Import duties are the single biggest economic barrier

- Manufacturing is the real long-term unlock

- Early Tesla models in India would be premium, not mass-market

- Policy certainty matters more than hype or demand

Table of Contents

Tesla and India — A Timeline Without Commitment

Tesla has never ignored India. It has revisited it repeatedly.

Each phase follows the same pattern:

- Initial optimism and public interest

- Policy discussions around import duties

- Strategic pause when economics don’t align

The key misunderstanding in most coverage is equating talks with execution.

Large automakers engage governments constantly. They commit only when numbers work.

Why Tesla Hasn’t Entered India Yet

Import Duties Break Tesla’s Pricing Model

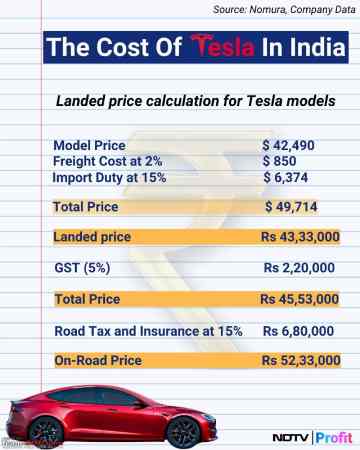

India imposes high duties on fully imported cars. For Tesla, this pushes prices firmly into luxury territory.

An import-only Tesla in India would:

- Serve a very small, premium audience

- Struggle to achieve meaningful volume

- Undermine Tesla’s scale-driven margins

Tesla does not enter markets to sell a few thousand cars.

India Is More Price-Sensitive Than Headlines Suggest

India’s EV adoption is growing—but growth is concentrated in:

- Two-wheelers

- Entry-level and mid-range cars

Tesla’s global success relies on selling at scale with cost control, not niche luxury positioning.

Ecosystem Gaps Still Matter

Beyond cars, Tesla needs:

- Dense service networks

- Reliable charging infrastructure

- Local supply chains

These are improving, but not yet at the level Tesla prefers before committing capital.

Import vs Manufacturing — The Real Fork in the Road

| Path | Advantages | Limitations |

| Import-only | Fast entry, low upfront investment | Very high prices, tiny market |

| Local manufacturing | Competitive pricing, scale potential | High capex, long timelines |

| Hybrid approach | Gradual cost reduction | Policy and supply uncertainty |

Core insight: Manufacturing is not optional for Tesla in India. It is the decision gate.

This is why announcements without factory clarity change very little.

What Tesla Would Cost in India (Scenario-Based)

These are illustrative scenarios, not predictions.

- Import-only: firmly luxury pricing, low volumes

- Partial localization: premium but somewhat competitive

- Full manufacturing: only path to broader adoption

This is why “affordable Tesla India” narratives are misleading in the near term.

What Has Changed Recently — and What Hasn’t

What has improved

- EV awareness among Indian consumers

- Charging infrastructure expansion

- Government openness to EV investment

What remains unresolved

- Long-term import duty clarity

- Stable manufacturing incentives

- Cost predictability over multiple years

Signals have improved. Fundamentals remain hard.

When Tesla India Finally Makes Sense

Tesla India becomes realistic when most of these are true:

- Clear, stable import or manufacturing policy

- Predictable long-term costs

- Ability to price beyond a tiny luxury niche

- Confidence in scaling operations

Until then, headlines should be read with caution.

Who This Is For (and Who It Isn’t)

This article is for:

- Consumers trying to set realistic expectations

- Investors tracking EV strategy, not news cycles

- Professionals analyzing India’s EV ecosystem

This is not for:

- Short-term speculators chasing headlines

- Buyers expecting a budget Tesla soon

Final Reality Check

Tesla India is not blocked by demand or brand appeal.

It is constrained by economics and policy alignment.

The moment those align, Tesla will move fast.

Until then, patience matters more than optimism.

FAQs

- Is Tesla coming to India?

Tesla has shown repeated interest, but it has not committed yet. Entry depends on whether import or manufacturing economics become viable at scale. - Why has Tesla delayed its India launch so many times?

Because pricing and margins do not work under current import duty structures. Interest alone is not enough for a sustainable launch. - Will Tesla cars be affordable in India?

Not initially. Early Tesla models in India would likely be premium-priced unless local manufacturing happens. - Is import-only Tesla launch possible in India?

Yes, but it would target a very small luxury segment and is unlikely to scale. - What needs to change for Tesla to manufacture in India?

Policy clarity, long-term incentives, and cost predictability are essential. Manufacturing requires large, irreversible investments. - Has India’s EV market matured enough for Tesla?

Partially. Infrastructure and awareness have improved, but mass-market readiness is still evolving. - Should consumers wait for Tesla India?

Only if you are interested in premium EVs and have no short-term purchase plans. Mass-market buyers should not wait. - Does Tesla India affect Indian EV startups?

Indirectly. Tesla’s entry would raise competition and expectations, but domestic players currently serve very different price segments. - Are government meetings a strong signal of Tesla’s entry?

They are signals of interest, not commitment. Economics matter more than meetings. - What is the single biggest blocker for Tesla India today?

Import duties and the lack of a clear, scalable manufacturing pathway.